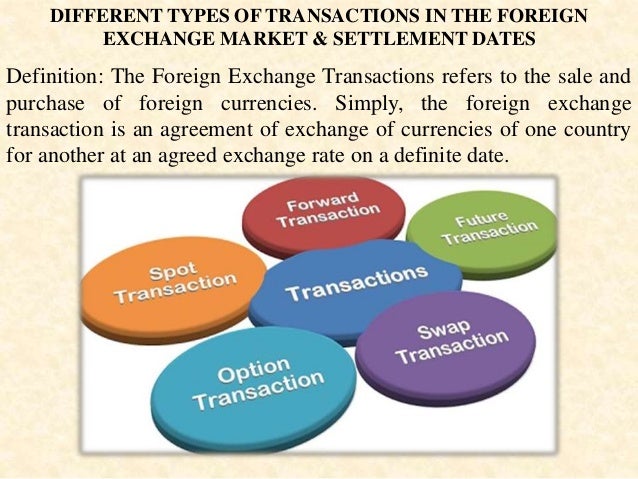

Consumers must convert domestic currency to make overseas purchases while businesses are concerned with trading international profits for domestic banknotes. The foreign exchange market is a place where individuals and institutes buy and sell foreign currencies the purpose of the foreign exchange market is to permit transfer purchasing power denominated in one currency to another.

What Is Foreign Exchange Exposure Definition And Meaning Business

What Is Foreign Exchange Exposure Definition And Meaning Business

This article provides a brief look at the advantages and disadvantages of trading in forex markets.

Foreign exchange and forex management. It is a contractual arrangement between the buyer and seller who agree in advance to share any fluctuations in foreign exchange rate movements. A one stop solution to manage risk is transaction forex risk advisory. Forex fx is the market where currencies are traded and the term is the shortened form of foreign exchange.

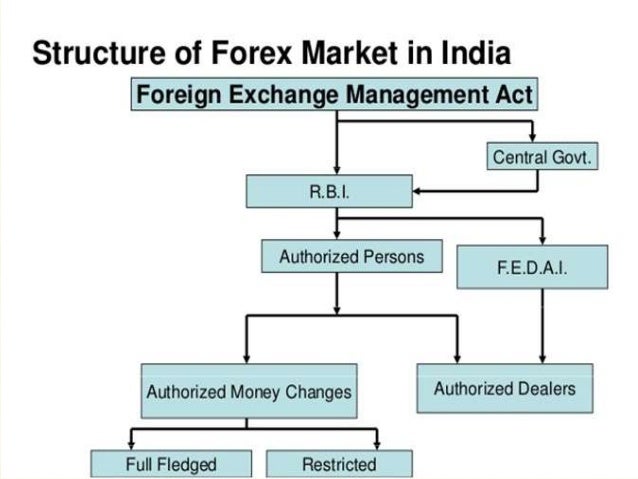

The foreign exchange management act 1999 fema is an act of the parliament of india to consolidate and amend the law relating to foreign exchange with the objective of facilitating external trade and payments and for promoting the orderly development and maintenance of foreign exchange market in india. Law of one price 2. With no central location it.

Each andevery firm adopts certain techniques to manage! the risk that will be faced. Foreign exchange or forex is ess! ential to transacting global business. Forex is the largest financial marketplace in the world.

Functions of foreign exchange market in forex management functions of foreign exchange market in forex management courses with reference manuals and examples pdf. Foreign exchange risk management. Interest rate parity theorem 3.

The following points highlight the five main theorems on foreign exchange rate determination. Foreign exchange management policy objectives and controls companies operating in international markets should establish management policies on foreign. In the foreign exchange market a financial risk management technique called value at risk var is used which examines the tail end of a distribution of returns for changes in exchange rates to highlight the outcomes with the worst returns.

The advantages are mostly related to flexibility whereas the disadvantages are mostly about excessive risk. !

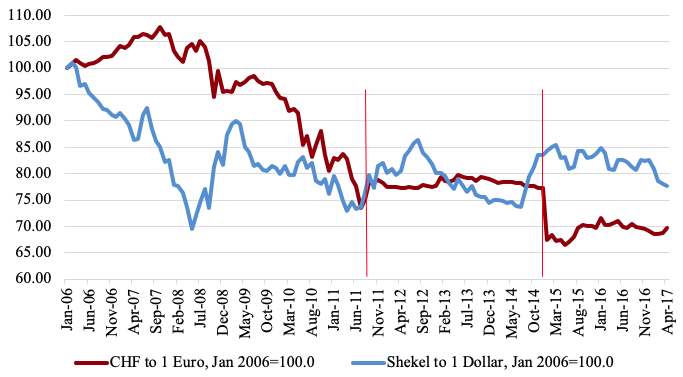

Forex Intervention And Reserve Management In Switzerland And Israel

Forex Intervention And Reserve Management In Switzerland And Israel

Forex Management

Forex Management

Foreign Exchange Sales Trading Metzler

Foreign Exchange Sales Trading Metzler

Fx Risk Management Hifm

Chapter 13 Hedging Foreign Exchange Risk

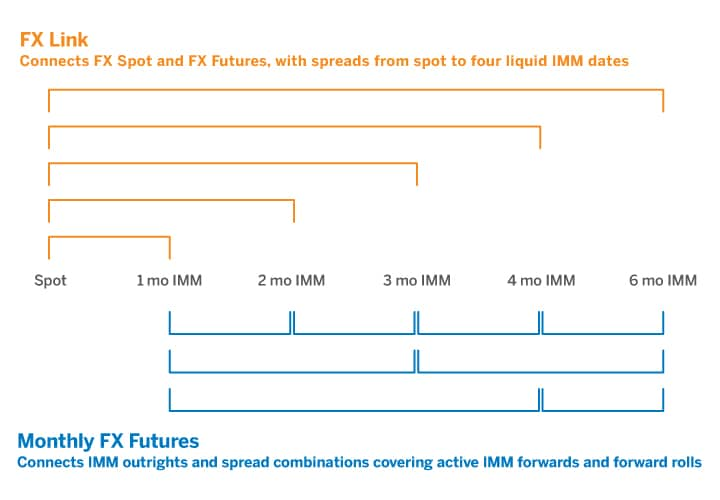

Fx Products

Fx Products

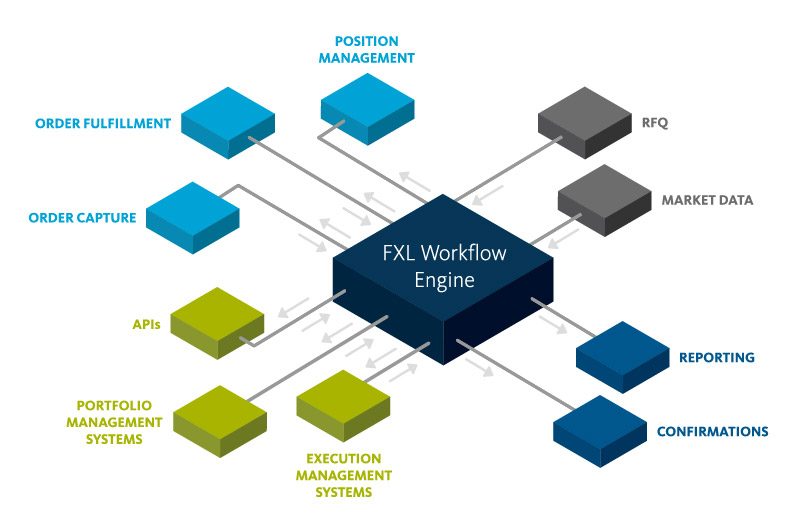

Foreign Exchange Trade Processing For Capital Markets Broadridge

Foreign Exchange Trade Processing For Capital Markets Broadridge

Fx Trading For! eign Exchange Market

Fx Trading For! eign Exchange Market

Cambodia Forex First Licensed Derivative Broker Cambodia Pps Forex

Advantages Of Dwelling In Foreign Exchange Markets Finance Topic

Foreign Exchange

Forex Management Chapter I

Forex Management Chapter I

Forex Management Chapter I

Forex Management Chapter I

! Potential Exchange Rate Determinants In Forex Management Tutorial

! Potential Exchange Rate Determinants In Forex Management Tutorial