Here some more examples for three pairs hedging. One of the things i consider the funniest about forex traders is that they seem to have a strong opposition against the removal of hedging from their trading capacity.

Using A Forex Hedge Strategy For Silver Trading Online

The core of my forex hedging strategy.

Hedging forex same pair. I will share these details with you in later blog posts. Because it causes such a big dd which can blow an account in very! short time so please do not try this at home. A forex option is an agreement to conduct an exchange at a specified price in the future.

Does hedging on the same currency pair really exist. Forex traders can be referring to one of two related strategies when they engage in hedging. This is as near to a perfect hedge as you can get but it comes at a price as is explained.

In that part of the market most hedging strategies are applied to reduce overall volatility in a portfolio or to lock in interest rates for a given period of time usually the lifeduration of the swap. Option hedging limits downside risk by the use of call or put options. But in this introductory post the most important thing that you can learn is the simple concept of the roll off.

I would suggest looking for a forex broker with the lowest spreads on these pairs and that allows hedging buying and selling a currency pair at the same time. My k! nowledge in hedging is limited to my background in derivatives! interest rate swaps and options. To protect that position you would place a forex strike option at 129.

Pair hedging is a strategy which trades correlated instruments in different directions. You got 1 tonne of grains or 1000 shares or simply buysell some foward futures contract with same value. A forex trader.

Hedging is a strategy to protect ones position from an adverse move in a currency pair. So the lower the spread you pay for these pairs the better. I call my forex hedging strategy zen8.

However few of them do realize that the traditional hedging we have seen where you buy and. For example say you buy a long trade position on eurusd at 130. Hedging is a rather complicated matter.

It is super flexible and there are a ton of nuances to this method. This is done to even out the return profile. Ive seen some posts where people talk about being long and short the same pair ex.

!Futures futures style hedging options and underlying stocks if you trade futures hybrid producer speculator and investor you can hedge it using various hedging strategy calendar options and even by buying the underlying assets. Same pair hedging am i missing something. A look at position holding in forex trading.

These pairs will give up 30 to 40 pips in a heartbeat. Buy buy sell or sell sell buy. July 16th 2010 5 comments.

Eurusd and they seem to have these complex hedging strategies that involve quite a bit of math. I used same lotsize on all three pairs and tp of 100 one might say hey why did you not trade just gbpusd and gbpchf.

Sure Fire Forex Hedging Strategy Win Every Time

Forex Hedging Strategy Learn Then Trade Fxscouts

Forex Hedging Strategy Learn Then Trade Fxscouts

:max_bytes(150000):strip_icc()/red-line-graph-with-man-682530865-1f3f185987264d7ab813a1d9b751c3ba.jpg) Learn About Forex Hedging

Learn About Forex Hedging

Currency Pai! r Correlations Forex Trading Octafx

Currency Pai! r Correlations Forex Trading Octafx

Fx Correlation Ea Expert Advisors And Automated Trading Babypips

Fx Correlation Ea Expert Advisors And Automated Trading Babypips

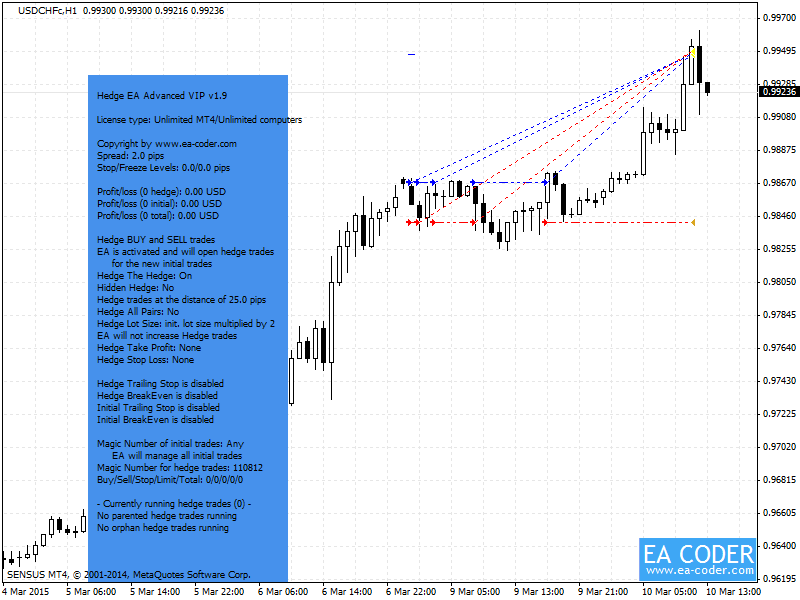

Hedge Ea Advanced Forex Trading App For Mt4

Hedge Ea Advanced Forex Trading App For Mt4

Developing A System 2 Entry System For Hedging Correlated Pairs

Developing A System 2 Entry System For Hedging Correlated Pairs

Forex Strategy The Us Dollar Hedge

Forex Strategy The Us Dollar Hedge

Sure Fire Forex Hedging Strategy Win Every Time

How To Hedge Forex Positions With Fx Hedging Strategies Ig Uk

How To Hedge Forex Positions With Fx Hedging Strategies Ig Uk

Three Pairs Hedging Page 21 Forex Factory

Currency Pair Correlations Forex Trading Octafx

Currency Pair Correlations Forex Trading Octafx

Forex Hedging Strategy Learn Then Trade Fxscouts

Forex Hedging Strategy Learn Then Trade Fxscouts

Hedging Strategies How To Trade Without Stop Losses

Hedging Strategies How To Trade Without Stop Losses

Forex Hedging Creating A Simple Profitable Hedging Strategy

Forex Hedging Creating A Simple Profitable Hedging Strategy