Forex Bar Charts Explained

How to read forex charts. With todays sophisticated financial market operating worldwide world currencies now have their own distinct sets of resources for measuring their worth over time.

Bar charts allow traders to analyze trends spot potential trend reversals and monitor volatilityprice movements.

Forex bar charts explained. The general forex or foreign exchange market. A simple line chart draws a line from one closing price to the next closing price. Lets take a look at the three most popular types of forex c! harts.

For forex traders candlestick charts seem to be the crowd favourite and its easy to see why. The commitment of traders cot reports provide a breakdown of each tuesdays open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the cftc. Commitment of traders cot charts are updated each friday at 3pm cst.

Partner center find a broker. Now well explain each of the forex charts and let you know what you should know about each of them. 3 types of forex charts and how to read them.

The chart below illustrates a textbook inside bar. Read this tutorial to find out how to perform technical analysis on these unique charts. An inside bar is characterized by the inside candles price action being completely covered from price action the day before.

Forex traders have developed several types of forex charts to help depict trading ! data. While range bars are not a type of technical indicator t! raders can employ range bar charts to identify trends and interpret volatility. A bar chart shows the open high low and close prices for a specified period.

The three main chart types are line bar and candlesticks. This is a type of chart format that doesnt use a time frame. How to read forex bar charts they are popular because they are easy to construct and understand.

These charts are constructed by representing intraday daily weekly or monthly activity as a vertical bar.

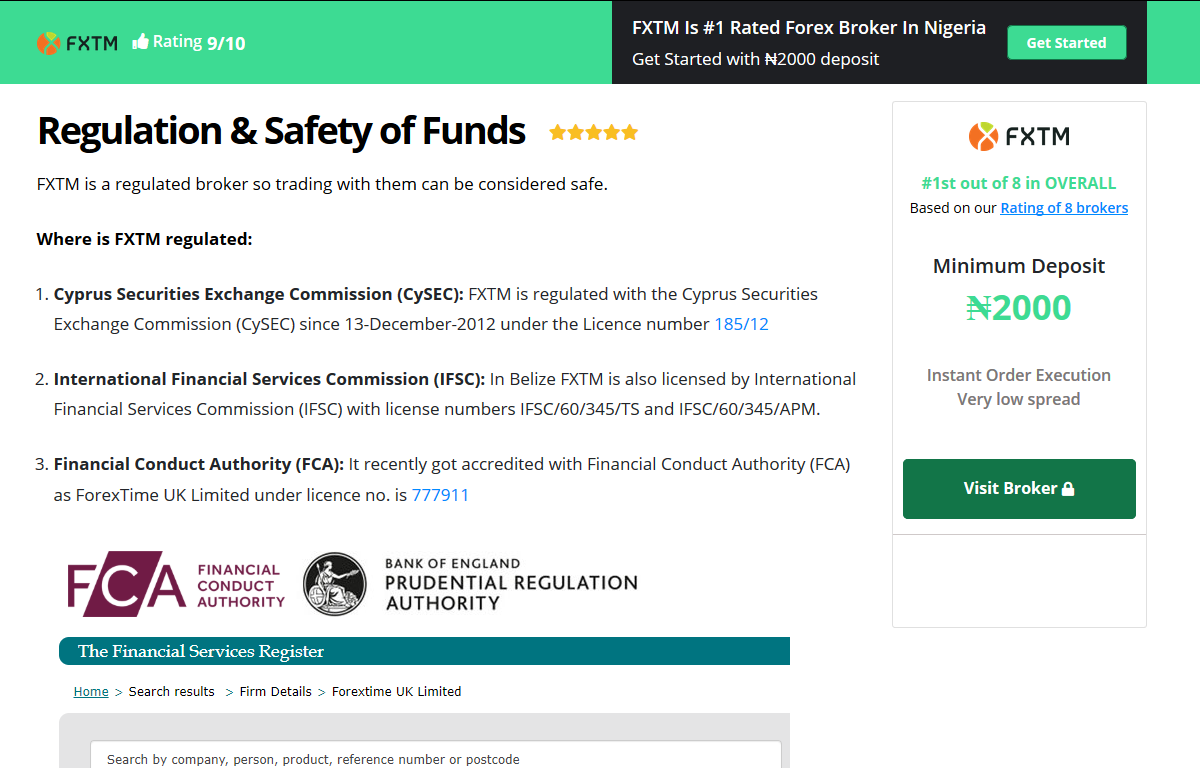

6 Best Forex Brokers In Nigeria 2019 Ranked Forextrading Ng

6 Best Forex Brokers In Nigeria 2019 Ranked Forextrading Ng

.JPG) Philippine Civil Engineering Review Tips And Guides Prc Approved

Philippine Civil Engineering Review Tips And Guides Prc Approved

Forex Trading Scams Written By Forex Lawyers

Forex Trading Scams Written By Forex Lawyers

Early Monday Trading Sending Usd Jpy Back Towards It Friday Post Nfp

Early Monday Trading Sending Usd Jpy Back Towards It Friday Post Nfp

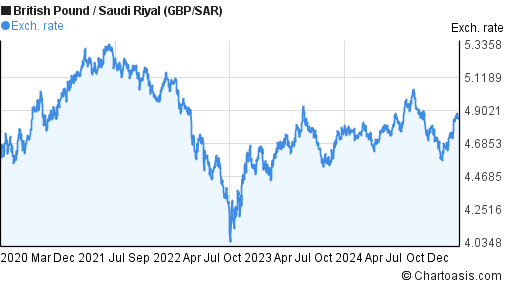

Gbp Sar Pound To Saudi Riyal Forex Forecast With Currency Rate Charts

Gbp Sar Pound To Saudi Riyal Forex Forecast With Currency Rate Charts

Feliz Dia Da Mentira 1 De Abril Unick Forex

Feliz Dia Da Mentira 1 De Abril Unick Forex

Forex Trading For Beginners Don T Waste Your Time Like This

Forex Trading For Beginners Don T Waste Your Time Like This

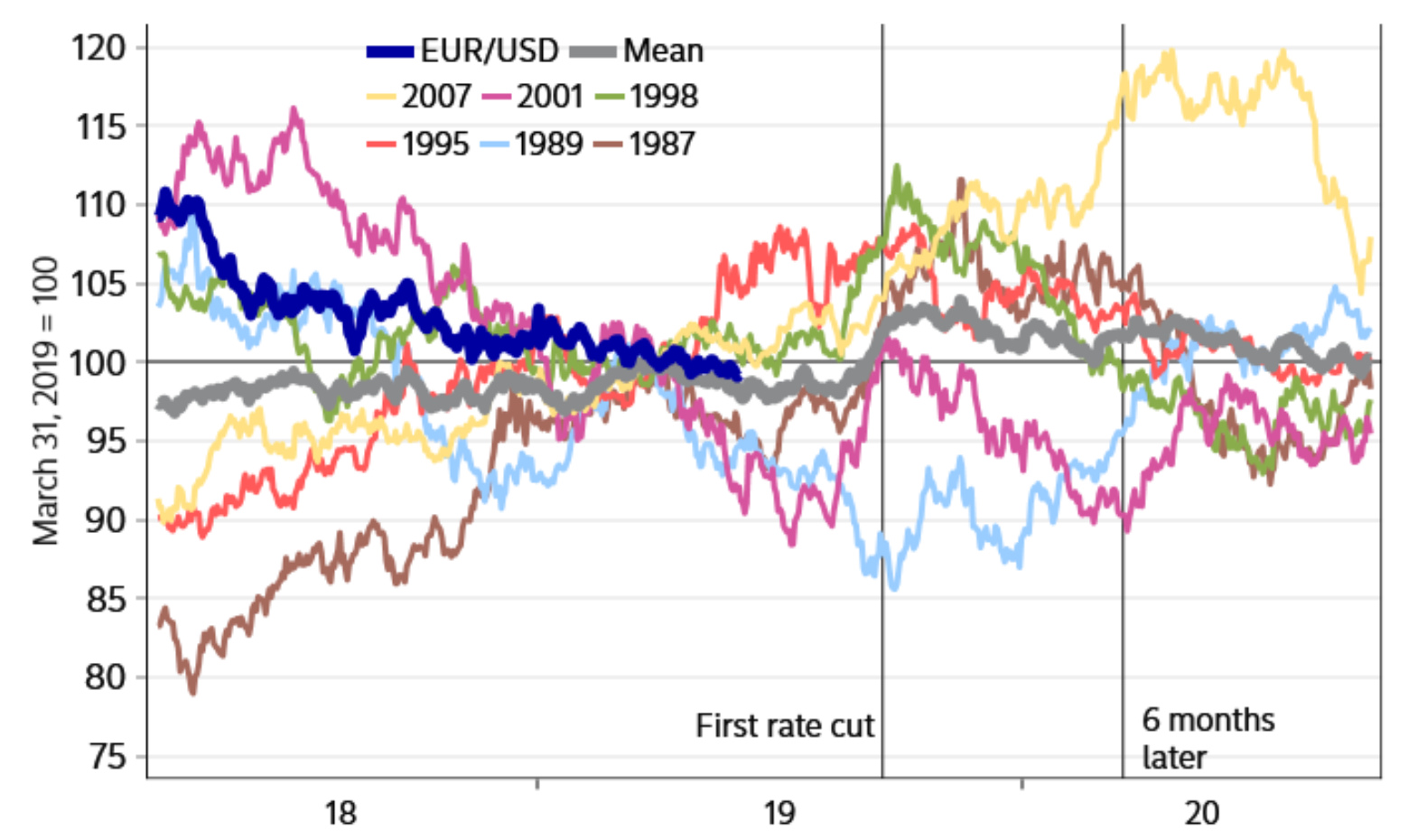

Lessons From Taper Tantrum Why These Asian Nations Are Building

Lessons From Taper Tantrum Why These Asian Nations Are Building

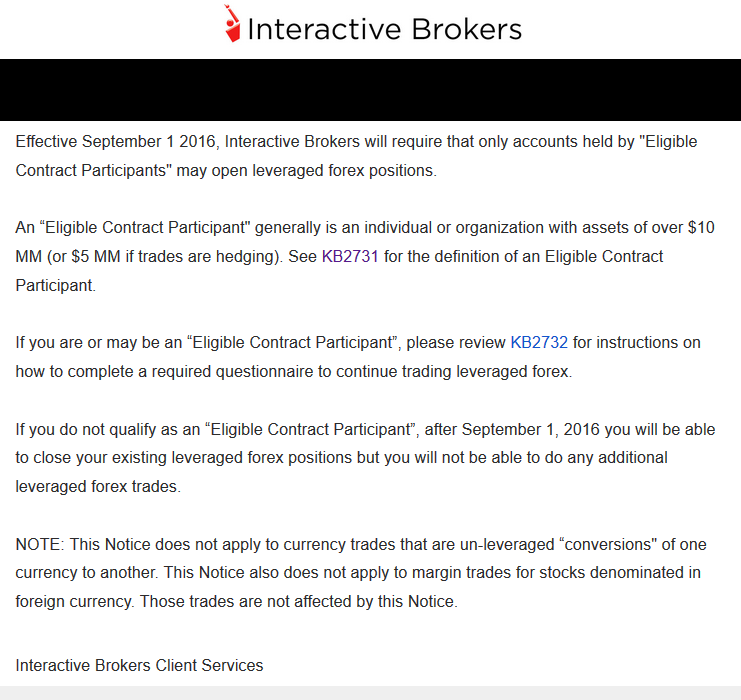

Interactive Brokers To Cut Off Us Forex Clients Sept 1

Interactive Brokers To Cut Off Us Forex Clients Sept 1  22yr Old Rich Forex Trader Living The Millionaire Lifestyle Fxlifestyle

22yr Old Rich Forex Trader Living The Millionaire Lifestyle Fxlifestyle

Forex Trend Analyzer Pro

Forex Trend Analyzer Pro

Zimbabwe S Rtgs Dollars Explained Iol Business Report

Zimbabwe S Rtgs Dollars Explained Iol Business Report